Do you want to know more about the MScBA Accounting & Financial Management programme?

The video below will answer the most frequently asked questions about the programme.

Overview

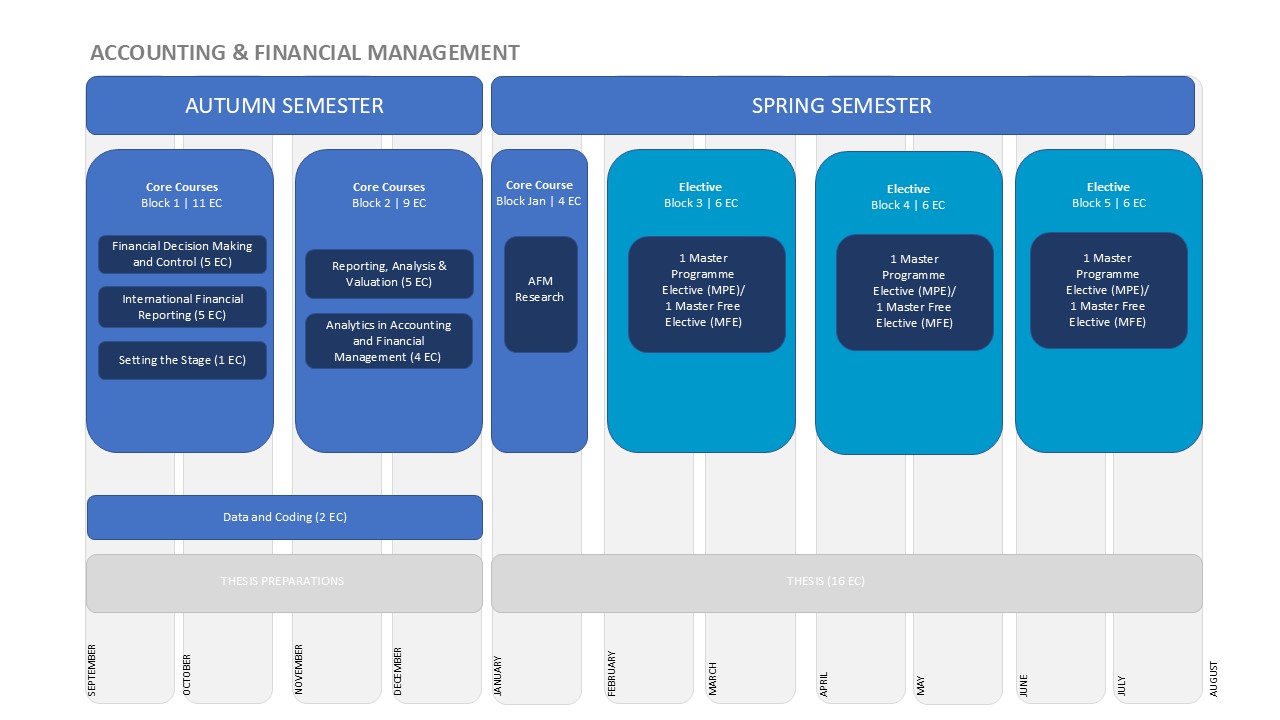

The MScBA in Accounting & Financial Management is a 12-month programme. Core courses are compulsory and will be offered during the autumn semester (22 EC). Master electives (18 EC) are offered during the spring semester, of which one elective can be chosen from another MSc programme. During the year, you’ll also work on a master thesis (20 EC).

MSc programmes are often associated with a research group, guided by accomplished researchers making meaningful contributions in their respective fields. For a closer look at the exciting research initiatives by our academic faculty, we encourage you to explore the department of Accounting under which the MScBA in Accounting & Financial Management falls.

Please note that core courses and electives are subject to change each academic year. While some electives are very popular and we can place most students in the elective(s) of their choice, there are no guaranteed places.

Focus on the crucial role that finance and accounting plays for companies, external stakeholders and society. In the evidence-based knowledge courses, you focus on:

Choose your specialisation path for your career in accountancy, financial management and controlling, or financial advisory. Elective courses* cover a wide variety of topics, including:

- Assurance Services

- Management Control

- Taxation

- Controllership

- Integrated Measurement and Reporting

- Behavioural Finance

- Accounting, Analysis and Governance in Complex Deals

You can also choose one elective from another MSc programme.

*Please note that certain electives may be very popular. Although we can place most students in the elective(s) of their choice, there are no guaranteed places.

For a detailed description of all of the courses including electives, please view the course catalogue (for reference only, catalogue continually updated throughout the year).

The goal of this course is to enable students to understand, perform, and critically evaluate research in accounting. Successful completion of the course will prepare you for your thesis.

You will explore topics like accounting theories, financial and accounting management research, and how to identify relevant and executable research questions. You will also discuss benefits and limitations of different research methodologies.

The course is taught over nine sessions in January by Marcel van Rinsum and Arndt Weinrich.

Learn more

You can get a taste of working life – from large multinationals to fast-growing start-ups – by applying your new wealth of knowledge to a real company problem during your internship, which is optional in your programme. The RSM Career Centre can support you in your search in finding a suitable position. Many students acquire their first job after graduation from the contacts they make during their internship.

Explore the world and broaden your study experiences by going on international study trips and exchanges at other top schools. RSM has an extensive partner school network of more than 100 business schools and universities worldwide, including top business schools such as ESADE in Barcelona and the Singapore Management University. An international exchange is an optional element after you’ve studied for your master for at least one year.

The Accounting & Financial Management Master prepares you for a broad range of career opportunities. Accounting & Financial Management graduates generally start their careers in one of the following functional areas:

- as an (external) auditor at one of the Big Four or medium-sized accounting firms

- as an (internal) auditor at a large multinational corporation

- as a finance manager and control specialist (such as financial controller, treasurer, business analyst) at a large multinational corporation

- as a financial or valuation advisor at a consulting firm or the transaction services department of the Big Four accounting firms.

Many of our graduates advance into senior management positions such as partner in an accounting firm, financial director, or senior business controller at a large company. An Accounting & Financial Management degree gives you a great start on your way to becoming a chief financial officer, a chief audit executive or senior audit partner!

When you graduate from this programme, you’ll be a specialist in the financial and non-financial information needed by managers and investors; how it is gathered, secured, checked and used in the ‘nerve centres’ of economic organisations and markets. This means you can contribute to help managers make economically sound and sustainable decisions. Such decisions range from motivating and evaluating employees, deciding on investments or mergers and acquisitions, to scrutinising new business opportunities.

Curious to see what our alumni are doing?

Good to know

Non-EEA nationals who have earned a diploma from a higher education institute in the Netherlands can apply for a special residence permit called the orientation year after completing their studies. The 'Orientation Year for Graduates Seeking Employment' is a residence permit aimed at retaining foreign talent for the Dutch labour market. During this orientation year you are free to work without a work permit. Participants who find a job during this period can change their orientation year into a residence permit for Highly Skilled Migrants under more favourable terms.

For the most up-to-date information please visit the following website.

What's next after your studies? The RSM Career Centre is your guide for an impactful career. Its expertise in the labour market, personal branding and connections with employers will prepare you for your business career. Get ready for some exciting job fairs, workshops, speed interviews and coaching. You may land your first internship or job before you even graduate!

You’re a member of the RSM community from Day 1. After you graduate, you’ll also be a member of the RSM alumni network. The countless benefits include networking events worldwide with local chapters, lifelong learning and professional development, mentoring opportunities and access to the latest business knowledge and research. Your study at RSM is the first step towards being part of this inspiring community that you’ll be part of forever.

Talk to our current students!

The 2025-2026 tuition fee for the MSc programmes is approximately €24,600 for non-EEA students. The Dutch government contributes towards this cost for students who hold a nationality from a country belonging to the European Economic Area (EEA). These students therefore only pay the statutory fee €2,601 in 2025-2026.

For EEA nationals who have already completed a master in the Netherlands (and obtained the diploma) the tuition fee for a 2nd master is approximately €14,400.

Please note that all these tuition fee tariffs are subject to change.

There are other costs associated with the Master programmes, for more information please review the “Other expenses” section below thoroughly.

Scholarships

The number of scholarships is limited and mainly merit based. If a scholarship covers only the tuition fees, be aware that you need to finance your own living expenses (rent, food and insurances) for the duration of your studies. RSM does not offer scholarships for the pre-master programme. We do however offer a maximum of 2 scholarships per academic year to RSM pre-master students enrolling in an MSc programme.

Rotterdam School of Management, Erasmus University (RSM) offers multiple scholarships to prospective students from non-EEA countries who are not entitled to pay the EEA tuition fee, provided their grades are considered ‘excellent’. RSM also offers one scholarship, the Erasmus Trustfonds Scholarship, to students from EEA countries.

Besides scholarships awarded by RSM, there are also scholarships awarded by the Dutch government or other organisations that are available if you meet certain criteria such as nationality, age, etc We have listed some of them below but we encourage you to use resources such as Grantfinder or the Scholarship Portal to find additional scholarships.

- StuNed

- G&D Europe Scholarship

- NN Future Matters Scholarship

- Russia: The Global Education Programme

- LPDP

- OKP

Scholarship tips

- Contact the Ministry for Higher Education in your home country to see whether there are scholarship options.

- We have virtual information session covering all you need to know about scholarships and financial aid. Watch it here.

For students from the Netherlands or the EU/EEA, it may be possible to apply for limited funding towards payment of your tuition fees. Find out whether you meet the nationality and age requirements and read more information about the application process here.

IM/CEMS is a program that - if you are still eligible - entitles you to a maximum of 1 year's use of your DUO entitlements. Students who have received a basic grant and possibly a supplementary grant from DUO in the first year of IM/CEMS and meet the following additional conditions may be eligible for an additional half year (6 months) of financial support, which is equal to the grant received in the last month during the program. Please contact the student counselors for more information.

Conditions Financial Support Fund

Students eligible for financial support due to extended master programmes are those who:

a) are enrolled full-time in a public funded Erasmus University Rotterdam degree programme, which is extended on the base of article 7.4, paragraph 8 of the Dutch Higher Education and Research Act;

b) are enrolled as first enrollment (hoofdinschrijving) in the study programme as referred to under a, for which the student pays statutory tuition fee;

c) for this program, is or was entitled to study finance (prestatiebeurs hoger onderwijs) as referred to in the Wet Studiefinanciering 2000, and during the period corresponding to the study load that exceeds 60 ECs, and is no longer eligible for student finance in the form of an additional grant.

Other expenses

After having filled in all of the necessary application information on the Online Application Form (OLAF) and uploaded the required documents, applicants with a degree obtained outside the Netherlands will be asked to pay a non-refundable €100 handling fee. This fee can be paid online via the Erasmus Payment System which uses either iDEAL (for those with a Dutch bank account) or PayPal (which can be linked to any bank account or credit card worldwide). It is important that applicants complete the payment process as indicated, otherwise the system cannot register the payment.

The additional expenses in addition to tuition and general living costs (see below) vary per programme and may include:

- Study materials such as books, readers and business cases

- Costs involved in kick-off meetings

- Costs related to travel, international excursions and compulsory exchange semesters or internships abroad

Approximately € 300 - 500 (per year), these costs differ per programme.

For a reasonable standard of living in the Netherlands, you should have an income of between €1,235-€1,735 per month depending on your lifestyle. Further information about the costs of living in the Netherlands and related subjects can be found on this website. Below is an example of monthly expenditures:

| Furnished accommodation, including gas and electricity | € 500-1,000 |

| Medical insurance | € 50 |

| Telephone/internet | € 15-40 |

| Food | € 300 |

| Books, recreation, clothing | € 300 |

| Public Transportation | € 50 |

| Total | € average 1235 - 1735 |

| Other potential expenses: | |

| Buying or renting a bike | € 100 - 250 (per year) |

| In private residence (not student housing) yearly municipal and water taxes | € 100 - 300 (per year) |

| Study trip or other study related travel | € 300 - 500 (per year) |

Please ensure, prior to your arrival at RSM, that you have or will have sufficient funding available to finance your stay at RSM. Finding a part-time job, may be an option, but can not be guaranteed. You should therefore not rely on finding other ways to supplement your income during your studies. For additional information on obtaining a part-time job, visit the website of the Nuffic.

For EEA students there are no formal restrictions in finding work in the Netherlands, but students with a lack of Dutch language skills will find it difficult to secure employment. Non-EEA students are subject to labour regulations, which makes the likelihood of obtaining a work permit very small. We therefore ask students not to rely on this possibility. We do not encourage students to combine studies with the heavy workload from a part-time job.

Application opens 1 October. This is a capped programme which means that the application will close either when the maximum number of applications (460*) has been reached or 15 May, whichever comes first. *Subject to change.

Find out everything you need to know about entry visas & residence permits for non-EU or EEA students at RSM.

Finding housing in Rotterdam can be tricky. To help you in your search for housing, we have compiled some helpful resources